summit county utah sales tax

Summit County Utah Recorder-4353363238 Assessor-4353363211. What is the sales tax rate in Summit County.

Taxes are Due November 30 2021 Youll need your 7-digit Account Number to make payment.

. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor. Sales Tax Breakdown Summit Details Summit UT is in Iron County. As for zip codes there are around 9 of them.

The Utah sales tax rate is currently. The committee is governed by the enabling Statutes and its bylaws. Summit County Utah Property Tax Go To Different County 192100 Avg.

The analysis does not deal with the Resort Community Tax 11 or the Citys Transit Tax 30. Location The 2022 Summit County Tax Sale will be held online. Report and pay this tax using form TC-62F Restaurant Tax Return.

Summit UT Sales Tax Rate Summit UT Sales Tax Rate The current total local sales tax rate in Summit UT is 6100. The Summit County Council established the Restaurant Tax Advisory Committee to investigate advise and recommend the best uses of the funds collected from this tax. 778 Average Sales Tax Summary Summit County is located in Utah and contains around 7 cities towns and other locations.

Manage Summit County Funds. The Treasurer is responsible for the banking reconciliation management and investment of all Summit County funds. Wayfair Inc affect Utah.

039 of home value Yearly median tax in Summit County The median property tax in Summit County Utah is 1921 per year for a home worth the median value of 492100. The average cumulative sales tax rate between all of them is 778. The sales tax numbers are estimates based on the l local option tax that is assessed in Park City.

Tax rates are provided by Avalara and updated monthly. The Summit County sales tax rate is. Utah UT Sales Tax Rates by City The state sales tax rate in Utah is 4850.

274 rows 6958 Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. The 2018 United States Supreme Court decision in South Dakota v. Deadline for 2022 Tax Relief Applications.

The most populous location in Summit County Utah is Park City. This is the total of state county and city sales tax rates. E-checks are free credit cards 265 convenience fee.

Look up 2022 sales tax rates for Summit Utah and surrounding areas. With local taxes the total sales tax rate is between 6100 and 9050. The Summit County sales tax rate is.

The December 2020 total local sales tax rate was also 7150. See Utah Code 59-12-602 5 and 59-12-603 1 a ii Pub 55 Sales Tax. The restaurant tax applies to all food sales both prepared food and grocery food.

Finally all data presented in this report is organized by fiscal year and fiscal quarter. How Does Sales Tax in Summit County compare to the rest of Utah. Summit County Home Page.

A full list of these can be found below. The Tax Sale is advertised in the Park Record four times once in each of the four successive weeks immediately preceding the date of the Tax Sale. 2022 Property Tax Due Date.

All Utah citiestowns listed alphabetically by county. The Utah state sales tax rate is currently. To review the rules in.

The Summit County Sales Tax is 155 A county-wide sales tax rate of 155 is applicable to localities in Summit County in addition to the 485 Utah sales tax. The County sales tax rate is. The minimum combined 2022 sales tax rate for Summit Park Utah is.

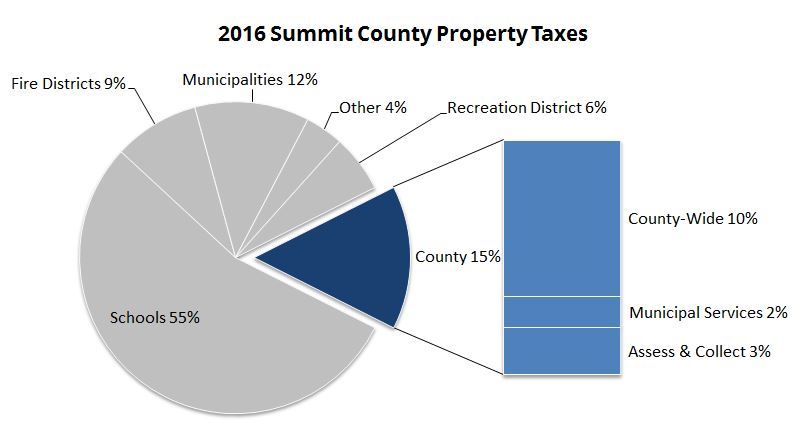

Alphabetical listing of all Utah citiestowns with corresponding county. Summit County collects on average 039 of a propertys assessed fair market value as property tax. Summit County UT Sales Tax Rate The current total local sales tax rate in Summit County UT is 7150.

There are a total of 131 local tax jurisdictions across the state collecting an average local tax of 2108. The following documents give cross-listings of Utahs cities towns counties and entity codes for sales and use tax purposes. Streamlined Sales Tax SST Training Instruction.

The fiscal year begins July 1 and runs through June 30 of. The 2018 United States Supreme Court decision in South Dakota v. State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes.

Some cities and local governments in Summit County collect additional local sales taxes which can be. 91 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Utah has recent rate changes Thu Jul 01 2021.

The December 2020 total local sales tax rate was also 6100. Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06. Has impacted many state nexus laws and sales tax collection requirements.

Did South Dakota v. Get rates tables What is the sales tax rate in Summit Park Utah. The entire combined rate is due on all taxable transactions in that tax jurisdiction.

The Summit County Utah sales tax is 655 consisting of 470 Utah state sales tax and 185 Summit County local sales taxesThe local sales tax consists of a 135 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. Cash management and investment duties are performed in. The Summit Park sales tax rate is.

Restaurant Tax Application Deadline is April 22nd at 500 pm. PAY ONLINE PAY BY PHONE Call 435 214-7550 to use our automated phone service. Important Property Tax Dates.

You can find more tax rates and allowances for Summit County and Utah in the 2022 Utah Tax Tables. The Ohio state sales tax rate is currently. Find Your Account Number Here.

Select the Utah city from the list of. Click here for a larger sales tax map or here for a sales tax table. The minimum combined 2022 sales tax rate for Summit County Ohio is.

This is the total of state and county sales tax rates. Have your account number handy.

Wasatch Summit County Property Taxes How They Work Park City Real Estate Agent Nancy Tallman

Corporate Retention Recruitment Business Utah Gov

Resources Early Childhood Alliance

Summit County Utah Republican Party

Utah Sales Tax Rates By City County 2022

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

Summit County Sales Tax Revenues Show Continued Economic Comeback In Wake Of Covid Parkrecord Com

2022 Best Places To Live In Summit County Ut Niche

Legislature Approves New Boundaries For Summit County Legislative Districts Parkrecord Com

10 For 20 At Purple Turtle Pleasant Grove Discount Coupon Purpleturtle Hamburgers Discount Pleasantgrove Diner Purple Turtle Pleasant Grove Turtle

One Utah Summit Oneutahsummit Twitter

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

Patagonia Logo A Defiant Brand From Day One Patagonia Logo School Creative Patagonia

Utah Summit County Parcels Lir Utah S State Geographic Information Database Agrc